If a house has a higher valuation, their flood insurance is going to reflect the higher valuation of their home, making it fair across the board,” said GILBERT GIRON, FEMA’s regional flood insurance liaison.Īccording to data given to NBC 5 by FEMA, when risk rating 2.0 goes into effect, 14% of policies in Texas will see an immediate decrease.īut 80% of policies will see increases, of up to $120 a year and 4% of policies will see increases of anywhere from $120 to $240 dollars per year. So a house that has a lower valuation is going to have a lower flood insurance premium and exactly the same the other way around. “We’re actually incorporating more variables to actually make it an individualized risk assessment for each house. The new methodology, known as risk rating 2.0, will consider other factors like flood frequency, your distance from a water source and the cost of rebuilding, as well as different types of flooding like a storm surge, river overflow and heavy rainfall. Until now, flood risk was based on a property's elevation and whether or not it was located in the 100-year floodplain. "I think there's a consensus in Congress and elsewhere that these policies do not accurately reflect the risk and that's how FEMA’s national flood insurance program got into such dire financial straits,” said Michael Barry, senior vice president at the Insurance Information Institute.

#Flood insurance cost texas registration#

Texas Rangers hosting voter registration eventĪnd now FEMA’s national flood insurance program is revamping how it calculates flood risk for the first time in 50 years. So now, when it rains it can be torrential rain, causing flash flooding," said Flecha. "So essentially, there is more moisture in the air. He said extreme rainfall has become more frequent and severe. so, what that means is the chances for flooding sometimes goes up," said Telemundo 39’s Chief Meteorologist, Nestor Flecha.įlecha said flooding and what happens after is something everyone should be aware of. Especially in areas along I-35 and east, it rains more. "One of the things we've seen here in Texas with climate change is that it rains more. People tend to think they will never fall victim to flooding until it happens.

#Flood insurance cost texas update#

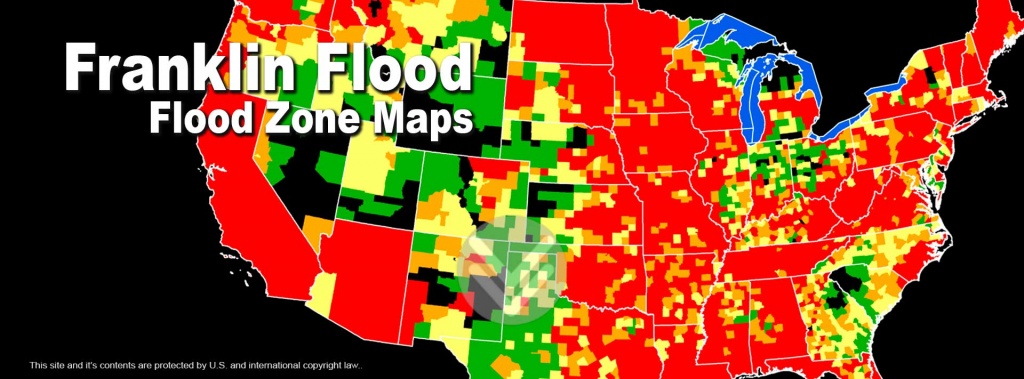

Typically, homeowners insurance doesn’t cover damage caused by floods and most flood insurance is through FEMA’s national flood insurance program, which has more than 760,000 policies in Texas.īut the agency is preparing an update first time in 50 years, promising property owners will no longer pay more than their share, based on the value of their homes. Starting October 1, homeowners could see an increase in premium to their flood insurance coverage.

0 kommentar(er)

0 kommentar(er)